An Investment Strategy for Better Returns

- Matt Erickson

- Feb 27, 2025

- 2 min read

Updated: Nov 12, 2025

Let's talk more specifically about the problem with the typical diversified portfolio investment strategy and our solution, an investment strategy for better returns.

Be sure to note the chart just after the 1 minute mark so you can compare how your investments are performing!

📖 Prefer to read over watch? The transcript is here.

If you would like to schedule a meeting to learn more, you can do that here. As always, I welcome your thoughts and questions; feel free to email me.

Sincerely,

P.S. Get more details about our investment strategy here!

TRANSCRIPT:

Hi. I'm here to talk to you today about every investor's two most important concerns:

1. Keeping up with the market during great market up years.

2. Protecting from significant losses during the inevitable market down years.

The typical advisor addresses this by having you fill out a risk questionnaire, and then based on your risk profile, will put you into an outdated diversified portfolio—typically consisting of U.S. companies, international companies, bonds, and then a mixture of other investments.

This could possibly look like a 60/40, 80/20, or 90/10 type portfolio, and many times these are heavily concentrated in mutual funds, which tend to charge very high expense fees that many investors don't even know they're paying.

Also, many times, your advisor is not the one doing the trading for you; and, therefore, you're incurring additional fees from a third-party trader.

The problem is that these outdated strategies are really not based in today's reality, and it leads most investors to underperform the market year in and year out—and they don't even know it.

Over the past ten years, most investors believe that they have done really well because their portfolios have gone up. But most are surprised to find out that they have lost out on a significant portion of the market gains.

The great news is you don't have to continue in your current strategy!

At Convergent Financial Group, we focus on stocks and ETFs that are primed for growth and outperformance. We then strategically layer in other financial instruments to protect from significant losses in the inevitable down market. This allows us to more effectively manage risk while maximizing returns.

Our clients can sleep well at night knowing that we're likely to perform very well during up markets, and we're much better protected from significant losses in down markets—AND we can view these large pullbacks as huge opportunities.

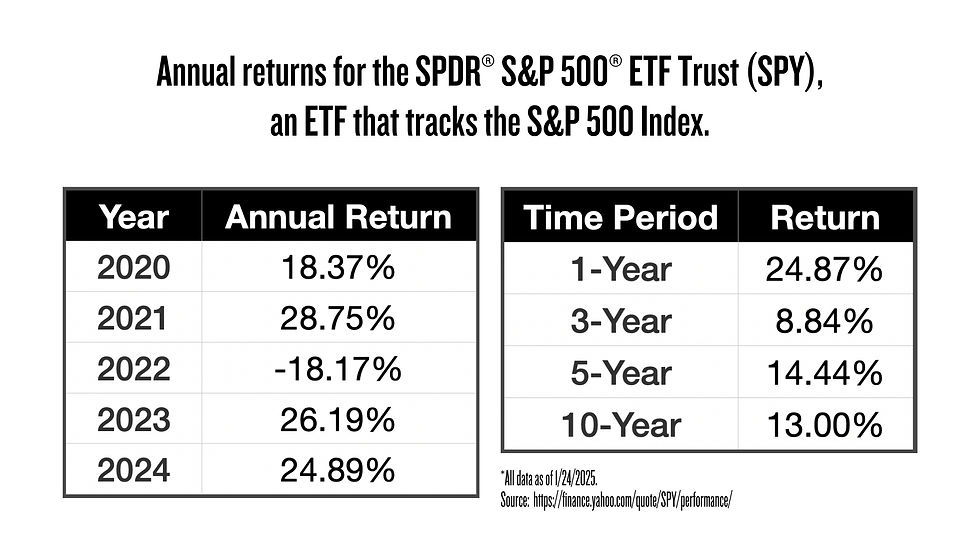

If your investments have not been keeping up with the market (check that here!) -- because you're part of an outdated diversified portfolio and your advisor's only real strategy is to rebalance this portfolio once or twice a year or you're tired of underperforming the market year in and year out and you want an investment strategy with better returns with a fiduciary advisor—please schedule a meeting with me. I'd be happy to review your portfolio and have a conversation with you.

Are your investments keeping up with market growth?